Platinum Wealth Partner's Comments

Current markets have all the makings of a 2000 Dot-Com bubble, just moments from bursting particularity when two giants Microsoft and Apple begin to stumble.

Signs that the gadgets, social media and mobile boom are approaching a peak are everywhere, including Google's huge market lift a few days ago. In all., it just smells like the smart money is heading for the higher ground.

Perhaps this is because the rest of the world looks pretty gloomy as Korea, japan and Brazil continue to add bad news to the poor global economy. Then remember there's China, Europe, Puerto Rico, pensions, bubbles real estate, low rates, and on ...

Who or what did we miss? Hmm.

Signs that the gadgets, social media and mobile boom are approaching a peak are everywhere, including Google's huge market lift a few days ago. In all., it just smells like the smart money is heading for the higher ground.

Perhaps this is because the rest of the world looks pretty gloomy as Korea, japan and Brazil continue to add bad news to the poor global economy. Then remember there's China, Europe, Puerto Rico, pensions, bubbles real estate, low rates, and on ...

Who or what did we miss? Hmm.

Good Luck; Be Careful Out There!

Microsoft reports biggest-ever quarterly loss

Microsoft Corp. said its revenue fell 5.1% in its latest quarter, hurt by continued weak PC demand, and posted its biggest quarterly loss ever on a hefty write-down and other items related to the Nokia mobile-phone business acquired last year.

For the period ended June 30, revenue decreased to $22.18 billion from $23.38 billion a year earlier. Analysts polled by Thomson Reuters expected revenue of $22.03 billion.

Per-share earnings, after stripping out the write-down and other one-time items, also beat expectations.

Microsoft's Windows smartphones have a tiny share of the smartphone market, which is dominated by market leader Apple Inc.'s iPhone.

Earlier this month Redmond, Wash.-based Microsoft said its was writing down about 80% of the $9.4 billion deal for Nokia's handset business and that it would cut more than 6% of its global workforce--mostly in its mobile-phone operation--a year after an earlier round of job cuts to the business.

Overall, Microsoft reported a loss of $3.2 billion, or 40 cents a share, compared with a year-earlier profit of $4.61 billion, or 55 cents a share. Excluding the write-down, restructuring charges and other items, per-share earnings were 62 cents. Analysts expected per-share profit of 56 cents.

The man who created one of the biggest U.S. subprime lenders says there’s nothing dangerous about borrowers being given longer car loans.

When Thomas Dundon helped start the lender that’s become Santander Consumer USA Holdings Inc. in the 1990s, subprime borrowers typically were offered four-year car loans, he said Monday in an interview. Now, the standard is six years, he said, partly because wages haven’t kept up with vehicle prices.

Using longer terms to lower payments makes sense when the alternative for consumers and lenders is “a shorter term with an older, cheaper, less-reliable piece of transportation,” he said, after being replaced as the lender’s top executive this month when Banco Santander SA bought out his minority stake.

OTTAWA—Canada’s budget watchdog Tuesday warned that the federal government’s push toward a budget balance masks a serious fiscal threat at the sub national level, where the country’s provincial governments are accumulating debt at an unsustainable pace.

Several Bank of Japan board members said the impact of the bank's massive stimulus might be fading, according to minutes of its June meeting, a sign that not all shared Governor Haruhiko Kuroda's optimism on achieving his 2 percent inflation target.

The nine-member board agreed underlying inflation, which excludes volatile food and energy prices, would continue to improve in the long term, the minutes published on Tuesday showed.

Some members said the reach of the BOJ's stimulus, dubbed quantitative and qualitative easing (QQE), remained substantial given that interest rates in Japan had been stable at a low level despite higher overseas yields, according to the minutes.

But pessimists on the board, such as former market economist Takahide Kiuchi, were less convinced that the stimulus remained powerful enough to keep bond yields at ultra-low levels even as QQE reflated the economy.

"A few members said the effects of QQE might be diminishing, considering long-term interest rates had temporarily risen to a range of 0.5 to 0.6 percent," according to the minutes.

South Korea’s finance minister said on Tuesday second-quarter growth is expected to be “much lower” than growth seen in the first quarter of this year.

South Korea’s finance minister said on Tuesday second-quarter growth is expected to be “much lower” than growth seen in the first quarter of this year.

“The global economic slowdown and lower oil prices have negatively affected Korea’s export performance,” Finance Minister Choi Kyung-hwan told reporters at a press event in Seoul.

Choi added domestic demand was dampened by the outbreak of the Middle East Respiratory Syndrome in late May.

“Taking these into consideration, we project that Korea’s real GDP growth in the second quarter will be much lower than the first quarter,” he said.

SAO PAULO – Brazilian airline TAM, partner with Chile’s LAN in Latam Airlines, announced Monday that it is reducing domestic operations by up to 10 percent and laying off 2 percent of staff as a result of the country’s economic crisis.

Brazil’s second-leading carrier in terms of market share said in a statement sent to securities regulators that the decision to trim operations responds to “the challenging economic scenario.”

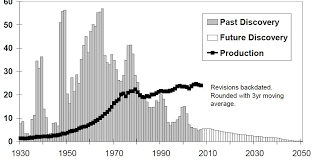

End Of Fossil Energy or Archaic Fabrications?

More Leading Headlines

Top Weekly Ideas and Insights

An Inconvenient Truth:

What Happens When The Fossil Energy Age Ends?

EXISTENTIAL REALITY

End Of Fossil Energy or Archaic Fabrications?