When Authorities "Own" the Market, The System Breaks Down: Here's Why

Panicked by the possibility of declines that undermine the official narrative that all is well, authorities the world over are purchasing assets like stocks, bonds and mortgages directly. Central banks are explicitly taking on the role of buyers of last resort on the theory that if they place a bid under the market to arrest any decline, private buyers will re-enter the market once they detect that the risk of a drop has dissipated.

The idea is that once private buyers flood back into the market, central banks can unload the assets they bought to stem the panic. In this view, the market is not based on fundamentals such as revenues, profits and price-earnings ratios--it's all about confidence. If central banks restore confidence by reversing any drop with massive buying, this central-planning manipulation will restore the confidence of private investors.

“We believe this decision is prudent as we continue to invest and redirect as much capital as possible into our world-class assets,” Chesapeake CEO Doug Lawler said in a statement. The company paid out 35-cents on an annualized basis, or approximately $240 million, funds that now can be plowed into revenue producing oilfields.

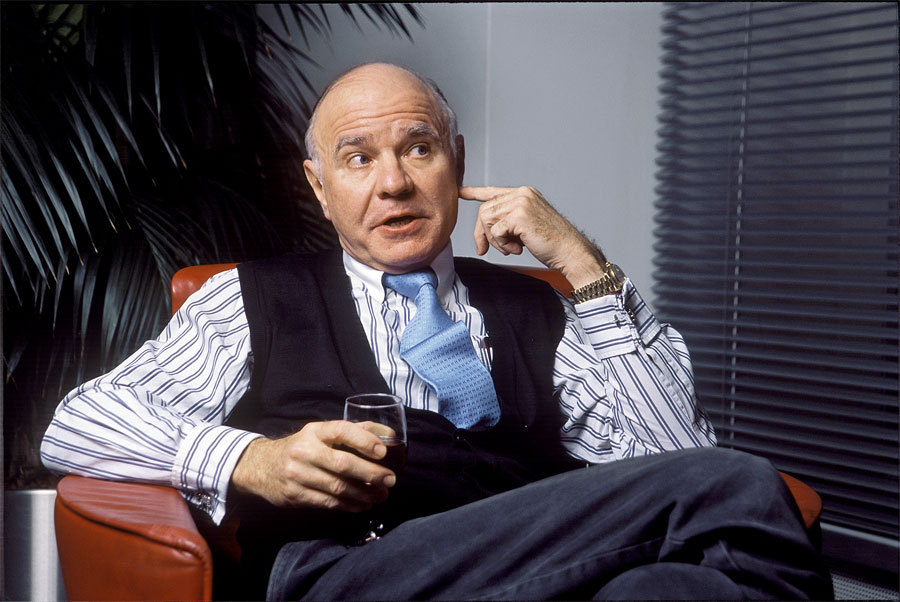

Marc Faber recommends Gold & Real Estate for an Investments outside The Banking System

“Gold is insurance if the banking system fails,” he said. “As an investor I’d like to own something outside the banking system, and that includes real estate, art and gold.”

Mr. Faber, publisher of the “Gloom, Doom and Boom” newsletter, made his comments Thursday July 16, 2015 at the CFA Analyst Seminar in Chicago in a presentation titled, “Inflating Asset Markets and Deflating Real Economic Activity? Strategies for Global Investors.”

Mr. Faber, publisher of the “Gloom, Doom and Boom” newsletter, made his comments Thursday July 16, 2015 at the CFA Analyst Seminar in Chicago in a presentation titled, “Inflating Asset Markets and Deflating Real Economic Activity? Strategies for Global Investors.”

Part of the problem resides in China. As the next chart shows, the correlation between the price of copper and the Chinese Manufacturing Purchasing Managers Index (PMI) has been very high. In particular, the copper price has a track record of anticipating the direction of the PMI index. The latest PMI reading earlier this week came in at 48.2 this week, still below the critical 50 level. It indicates that purchasing managers believe economic contraction is prevailing at this point.

These troubles have become all too common on the Northeast Corridor, the nation’s busiest rail sector, which stretches from Washington to Boston and carries about 750,000 riders each day on Amtrak and several commuter rail lines. The corridor’s ridership has doubled in the last 30 years even as its old and overloaded infrastructure of tracks, power lines, bridges and tunnels has begun to wear out. And with Amtrak and local transit agencies struggling to secure funding, many fear the disruptions will continue to worsen in the years ahead.

![[IMAGE DESCRIPTION]](http://cdn.theatlantic.com/assets/media/img/posts/happybuddahmain.jpg) "Happiness without meaning characterizes a relatively shallow, self-absorbed or even selfish life, in which things go well, needs and desire are easily satisfied, and difficult or taxing entanglements are avoided," the authors of the study wrote. "If anything, pure happiness is linked to not helping others in need.” While being happy is about feeling good, meaning is derived from contributing to others or to society in a bigger way. As Roy Baumeister, one of the researchers, told me, "Partly what we do as human beings is to take care of others and contribute to others. This makes life meaningful but it does not necessarily make us happy.”

"Happiness without meaning characterizes a relatively shallow, self-absorbed or even selfish life, in which things go well, needs and desire are easily satisfied, and difficult or taxing entanglements are avoided," the authors of the study wrote. "If anything, pure happiness is linked to not helping others in need.” While being happy is about feeling good, meaning is derived from contributing to others or to society in a bigger way. As Roy Baumeister, one of the researchers, told me, "Partly what we do as human beings is to take care of others and contribute to others. This makes life meaningful but it does not necessarily make us happy.”