PLATINUM WEALTH PARTNERS' INSIGHTS

Back on July 9th we issued a " BIG Market Warning" essentially stating that we are facing a perfect financial and market storm that could only be expected to get worse. Well it did. And moreover, key indicators are still pointing south.

" BIG Market Warning"

What's different this time too is that suddenly the once cash-rich oil-producing countries are heading for dior straits and they could be crippled financially by the fall in prices and demand volumes. The fact that Saudi Arabia, the world's largest oil producer is out raising money with new bond issues tells us a story of revenues that are now insufficient to cover its government's on-going expenditures. The implications of this are vast and frightening because risks regarding economic, social and political volatility rise dramatically. Much more could be said as to where this might lead -

It all ends badly.

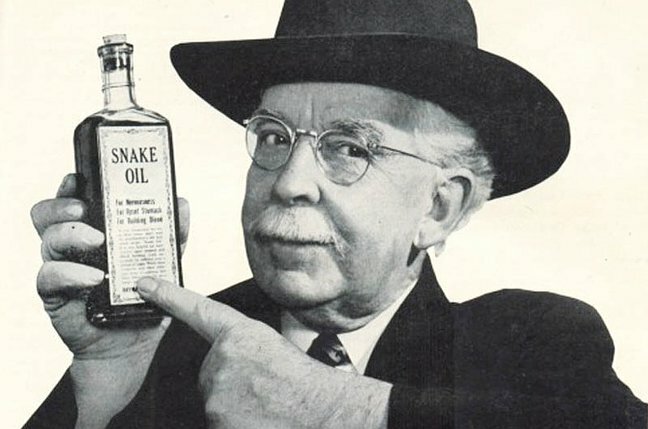

To sum up., what has transpired over the past four weeks is a metaphorical domino -effect on global stock markets, and then related economies. Industrial production is now slumping ,while consumer confidence is dropping like a stone in key economies. Most nations are urgently reaching into their bag of " stimulus gadgets" hoping - AGAIN - to ward off the inevitable wreckage .

At this point, their tricks are unlikely to pull a rabbit-out- of- the -hat, any time soon....

Saudi

Riyal Falls

In Forwards Market As Bond Issue Hits Liquidity

The Saudi Arabian riyal fell to its lowest forwards market level against the U.S. dollar in over six years on Tuesday as a rare bond issue by the Saudi government tightened liquidity in the kingdom's money markets.

One-year dollar/riyal forwards climbed as high as 144 points, their highest level since December 2008. Previously this year, they had been trading almost entirely in a range of zero to 100 points.

The bond issue pushed the cost of two-year riyal funds in the interbank market up to 1.53 percent this week from as low as 1.05 percent six weeks ago.

The government sold 20 billion riyals ($5.3 billion) of five-, seven- and 10-year bonds, only its second sovereign bond issue since 2007. Its first was in July, to quasi-sovereign institutions.

Malaysia’s economy has come under pressure as Brent crude prices that have more than halved from their 2014 peak to around $50 a barrel weigh on earnings for Asia’s only major net oil exporter. A government report on Thursday may show second-quarter growth slowed to 4.5 percent, the least since the first three months of 2013, according to the median estimate in a Bloomberg survey.

Greece reaches an agreement "in principle" with lenders for a third bail-out, but economists say fiscal targets are "utterly unachievable"

Latin American currencies fell on Tuesday after China's decision to devalue the yuan by nearly 2 percent fueled a sharp drop in commodities prices as well as concerns about the competitiveness of emerging market exporters.

Latin America's most traded currencies - including those of Mexico, Brazil, Chile, and Colombia - all dropped about 1 percent following the Chinese move,

Etsuro Honda says a more than $24 billion package needed if growth weakens as expected

Of course, all of this is great news for U.S. natural gas producers. Who are seeing a potentially huge source of demand emerging as pipelines into Mexico open up. By some estimates, Mexican consumers could take up to 10% of total U.S. natgas production over the next two to three years.

Whether midstream or E&P, this is a space that's going to create some of the biggest shifts -- and opportunities -- in global energy markets.

Stay tuned.

The United Kingdom saw the steepest single-year drop in greenhouse gas pollution in more than two decades in 2014, according to government data released on Thursday. The country's carbon emissions fell 8.4 percent, even as its economy grew by 2.6 percent.

The decline in carbon emissions was the largest ever in a year when the U.K. economy expanded, according to The Carbon Brief.

BEIJING--Chinese financial institutions issued 1.48 trillion yuan ($238.3 billion) worth of new yuan loans in July, up from 1.27 trillion yuan in June and above economists' expectations, data from People's Bank of China showed Tuesday.

Newly extended loans in July were above the 760.8 billion yuan forecast by a Wall Street Journal poll of 13 economists.

The PBOC said in a statement on its website that the higher loan growth was driven by government's recent supportive policies, stronger credit demand boosted by more investment and a recovering property market.

Learning Success:

APPLY Tips From The Best

PepsiCo, another of 100 Most Powerful Women - Forbes, has not only led her company to record financial results but is making strides to move PepsiCo in a healthier direction, leading the courageous charge to shed traditional fast food properties and to replace them with initiatives to supply healthier foods. She is deeply caring and committed as a senior executive. She is a fun-loving executive as well—she played lead guitar for an all-woman rock band in college, loved to play cricket, and is known to sing karaoke and perform at corporate gatherings to this day. Yes, I have been known to relate to her fun-loving spirit as a senior executive as well.

Top Weekly Ideas and Insights