#BERNIENOMICS: Shot in the Arm

Leading economist argues that Sanders' bold economic agenda would 'deliver standards of well-being for the overwhelming majority of Americans in ways that we have not experienced for generations.'

Economist Argues 'Pie in the Sky' Sanders Will, in Fact, 'Make Economy Great Again'

As the Democratic primary race tightens, Hillary Clinton has been trying to cast opponent Bernie Sanders as unrealistic and "pie in the sky," but a leading University of Massachusetts economist says such criticisms are "dead wrong" and, in fact, the Vermont senator's proposals are precisely what will "make the economy great again."

As the Democratic primary race tightens, Hillary Clinton has been trying to cast opponent Bernie Sanders as unrealistic and "pie in the sky," but a leading University of Massachusetts economist says such criticisms are "dead wrong" and, in fact, the Vermont senator's proposals are precisely what will "make the economy great again."

In a column published at The Nation on Tuesday, Robert Pollin, distinguished professor in economics at UMass Amherst and co-director of the Political Economy Research Institute (PERI), examines the major policy items under Sanders' economic agenda. These include a single-payer healthcare system; increasing the federal minimum wage to $15 an hour; free tuition at public colleges and universities, to be financed by a "Robin Hood" tax on Wall Street transactions; and large-scale public investments in renewable energy and infrastructure.

Railroad Stocks Hit Hard By Oil And Coal Collapse

“Applying sound management reforms to global fisheries in

our dataset could generate annual increases exceeding 16

million metric tons (MMT) in catch, $53 billion in profit, and

619 MMT in biomass relative to business as usual,” the

authors explain in their study. “We also find that, with

appropriate reforms, recovery can happen quickly, with the

median fishery taking under 10 [years] to reach recovery

targets. Our results show that commonsense reforms to

fishery management would dramatically improve overall fish

abundance while increasing food security and profits.”

Already, the downsides of such single-minded investment are

becoming visible in Portugal's property market where prices

in lucrative locations especially in the capital Lisbon have

gone through the roof, fuelling a mounting speculative

bubble. In addition, the cheap ECB money has also caused

public debt to start rising again,

Barter systems often emerge from monetary societies after

unforeseen events make money scarce, historians say: After

Rome fell, for example Europeans used barter as a substitute

for Roman currency.

New Green Challenge: How to

Grow More Food on Less Land

As the Democratic primary race tightens, Hillary Clinton has been trying to cast opponent Bernie Sanders as unrealistic and "pie in the sky," but a leading University of Massachusetts economist says such criticisms are "dead wrong" and, in fact, the Vermont senator's proposals are precisely what will "make the economy great again."

In a column published at The Nation on Tuesday, Robert Pollin, distinguished professor in economics at UMass Amherst and co-director of the Political Economy Research Institute (PERI), examines the major policy items under Sanders' economic agenda. These include a single-payer healthcare system; increasing the federal minimum wage to $15 an hour; free tuition at public colleges and universities, to be financed by a "Robin Hood" tax on Wall Street transactions; and large-scale public investments in renewable energy and infrastructure.

Railroad Stocks Hit Hard By Oil And Coal Collapse

“Applying sound management reforms to global fisheries in

our dataset could generate annual increases exceeding 16

million metric tons (MMT) in catch, $53 billion in profit, and

619 MMT in biomass relative to business as usual,” the

authors explain in their study. “We also find that, with

appropriate reforms, recovery can happen quickly, with the

median fishery taking under 10 [years] to reach recovery

targets. Our results show that commonsense reforms to

fishery management would dramatically improve overall fish

abundance while increasing food security and profits.”

our dataset could generate annual increases exceeding 16

million metric tons (MMT) in catch, $53 billion in profit, and

619 MMT in biomass relative to business as usual,” the

authors explain in their study. “We also find that, with

appropriate reforms, recovery can happen quickly, with the

median fishery taking under 10 [years] to reach recovery

targets. Our results show that commonsense reforms to

fishery management would dramatically improve overall fish

abundance while increasing food security and profits.”

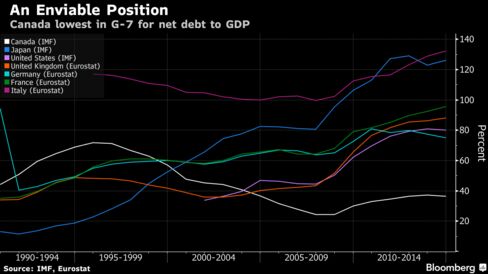

Already, the downsides of such single-minded investment are

becoming visible in Portugal's property market where prices

in lucrative locations especially in the capital Lisbon have

gone through the roof, fuelling a mounting speculative

bubble. In addition, the cheap ECB money has also caused

public debt to start rising again,

becoming visible in Portugal's property market where prices

in lucrative locations especially in the capital Lisbon have

gone through the roof, fuelling a mounting speculative

bubble. In addition, the cheap ECB money has also caused

public debt to start rising again,

Barter systems often emerge from monetary societies after

unforeseen events make money scarce, historians say: After

Rome fell, for example Europeans used barter as a substitute

for Roman currency.

unforeseen events make money scarce, historians say: After

Rome fell, for example Europeans used barter as a substitute

for Roman currency.

New Green Challenge: How to

For researchers trying to figure how to feed a world of 10 billion people later in this century, the great objective over the past decade has been to achieve what they call “sustainable intensification.” It’s an awkward term, not least because of conventional agricultural intensification’s notorious record of wasting water, overusing fertilizers and pesticides, and polluting habitats. But the ambition this time is different, proponents say: To figure out almost overnight how to grow the most food on the least land and with the minimal environmental impact. The alternative, they say, is to continue plowing under what’s left of the natural world. Or face food shortages and political unrest.